Letter of Credit

- Saturday 22nd June 2019

- Author: Shreya Uppal

Highlights

Under acceptance credit, these usance bills are accepted upon presentation and eventually honored on their respective due dates.

In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Citibank offers letters of credit for buyers in Latin America, Africa, Eastern Europe, Asia, and the Middle East who may have difficulty obtaining international credit on their own.

Due to the nature of international dealings, including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of Letters of Credit has become a very important aspect of international trade.

What is a Letter of Credit?

A letter of credit is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

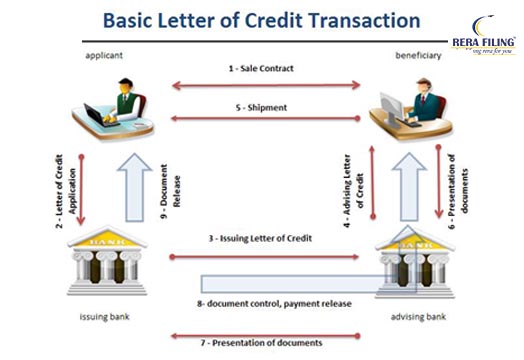

How it works?

1. It is typically a Negotiable Instrument. The issuing bank pays the beneficiary or any bank nominated by the beneficiary.

2. If a letter of credit is transferable, the beneficiary may assign another entity such as a corporate parent or a third party, the right to draw.

3. Banks typically require a pledge of securities or cash as collateral for issuing a letter of credit.

4. Banks also collect a fee for service, typically a percentage of the size of the letter of credit.

5. The International Chamber of Commerce Uniform Customs and Practice for Documentary Credits oversees letters of credit used in international transactions.

Parties to a Letter of Credit

1. Applicant (importer) requests the bank to issue the LC.

2. Issuing bank (importer’s bank which issues the LC, also known as the Opening Banker of LC.

3. Beneficiary (Exporter)

Types of Letter of Credit

1. Sight Credit

Under this LC, documents are payable at the sight/ upon presentation of the correct documentation. For example, a businessman can present a bill of exchange to a lender along with a sight letter of credit and take the necessary funds right away. A sight letter of credit is more immediate than other forms of letters of credit.

2. Time Credit

The Bills of Exchange which are drawn and payable after a period, are called usance bills. Under acceptance credit, these usance bills are accepted upon presentation and eventually honored on their respective due dates. For example, a company purchases materials from a supplier and receives the goods on the same day. The bill will be delivered with the shipment of goods, but the company may have up to 30 days to pay it. The 30 day period marks the usance for the sale.

3. Revocable and Irrevocable Credit

A revocable LC is a credit, the terms, and conditions of which can be amended/ cancelled by the Issuing Bank. This cancellation can be done without prior notice to the beneficiaries.

An irrevocable credit is a credit, the terms, and conditions of which can neither be amended nor cancelled. Hence, the opening bank is bound by the commitments given in the LC.

4. Confirmed Letter of Credit

A confirmed letter of credit involves a bank other than the issuing bank guaranteeing the letter of credit. The second bank is the confirming bank, typically the seller’s bank. The confirming bank ensures payment under the letter of credit if the holder and the issuing bank default. The issuing bank in international transactions typically requests this arrangement.

Example of LC

Citibank offers letters of credit for buyers in Latin America, Africa, Eastern Europe, Asia, and the Middle East who may have difficulty obtaining international credit on their own. Citibank’s letters of credit help exporters minimize the importer’s country risk and the issuing bank’s commercial credit risk.

Letters of Credit are typically provided within two business days, guaranteeing payment by the confirming Citibank branch. This benefit is especially valuable when a client is located in a potentially unstable economic environment.

More Articles

- Online Listing Tips for Real Estate Agents

- How to start a Real Estate business in India - a complete guide !

- Renting Vs Buying property - How will you decide?

- What you should do in Property Management services

- Home Loan Insurance

- How to choose your builder?

- How to ensure fire safety in your home!

- Tips To Keep In Mind While Taking A Home On Rent

- Importance of Home Security

- How to plan your property budget?

- Leased vs. Purchased vs. Co-Working Office Spaces

- Easy Tips to Build an Eco Friendly Home

- Sample Flat - A Trick by a Builder?

- How to have a Beautiful Guest Room? Impress your Guests with these Guest Room Ideas..

- Understanding MCLR and its Effects on Home Loans

- 5 simple ways to close a real estate deal

- Is it worth to buy property near an airport ?

- Home loan tax benefit

- How to be successful in business as an introvert

- Cost effective home decor ideas

- What to Be-Paying Guest or a Tenant??

- Complete guide to start your small business

- Sports township- New trend in India

- Online Listing Tips for Real Estate Agents

- Understanding Floor Area Ratio- FAR

- Town and Country Planning | Meaning and Importance

- Checklist of Important Property Documents- All You Need to Know

- Role of CREDAI in real estate

Copyright © 2023 RERA Filing. All rights reserved.

Rera

Act

Rera

Act

Maharashtra

Maharashtra Karnataka

Karnataka Andhra Pradesh

Andhra Pradesh Uttar Pradesh

Uttar Pradesh