Reduction in GST Rates in Real Estate

- Tuesday 23rd April 2019

- Author: Shreya Uppal

Highlights

To avail the benefit of 5% for affordable housing and 1% for under-construction flats, two conditions have been put by the Government which says that: 1. ITC shall not be allowed on new rates. 2. 80% procurement (i.e. inputs and input services purchases) by developers should be from registered dealers, to avail of the composition scheme

The new tax rate of 1% for affordable houses and 5% for others, without ITC, will apply on new projects.

In recent days, a transition plan for the implementation of the new tax structure for housing units has been approved by the GST Council. As per the plan, builders will be allowed to choose between the old tax rates and the new ones for under-construction residential projects, to help resolve input tax credit (ITC) issues.

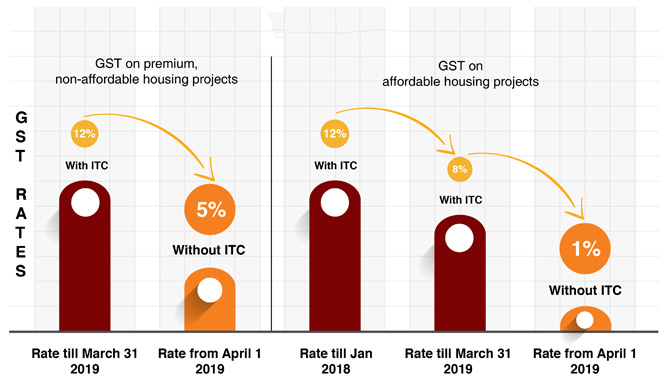

Earlier, GST rates on affordable housing and under-construction flats were 8% and 12% respectively on which ITC can be availed. Now, the council has expanded the definition of affordable housing for the purpose of availing of GST benefits. Now, for affordable housing units, the existing tax rate is eight per cent, but they have given benefits to those:

- Flats costing upto Rs.45 lakhs and measuring 60sq mtrs. Carpet area in metros (Delhi-NCR, Bengaluru, Chennai, Hyderabad, Mumbai-MMR and Kolkata) to levy rate @ 5%

- Flats costing upto Rs.45 lakhs and measuring 90 sq metres carpet area in non-metros to levy rate @5%.

They have adopted twin definition of affordable housing, on the basis of carpet area and cost. They have expanded the definition of affordable housing, so that aspiring people can buy slightly bigger (houses), so 60 sq metres carpet area in metros and 90 sq metres outside the metros, which approximate translates to a two-bedroom house in a metro and a possibly three-bedroom house in non-metros. This will come into effect from April 1, 2019.

To avail the benefit of 5% for affordable housing and 1% for under-construction flats, two conditions have been put by the Government which says that:

- ITC shall not be allowed on new rates.

- 80% procurement (i.e. inputs and input services purchases) by developers should be from registered dealers, to avail of the composition scheme.

Any shortfall in purchases according to these norms, would levy a tax of 18 per cent. Tax on cement purchased from unregistered person shall attract a 28% duty.

The new GST-related announcement has given real estate developers the choice to either opt for the old rates and the accompanying input tax credit (ITC) benefits, or else to adhere to the new reduced GST rate of 5% without ITC. While not exactly ground-breaking, it is indeed an intelligent move by the incumbent government. With this decision, it has carefully side-stepped conflict with both builders and buyers. As far as the developers of residential projects which are incomplete as on March 31, 2019 are concerned, they have an option either to choose the old structure with ITC or to shift to the new 5% and 1% rates, without ITC. Builders will get a one-time option to continue paying tax at the old rates (effective rate of 8% or 12% with ITC) on ongoing projects (buildings where construction and actual booking have both started before April 1, 2019, but which will not be completed by March 31, 2019).

The new tax rate of 1% for affordable houses and 5% for others, without ITC, will apply on new projects. There was justifiable worry about what would happen to the input stock which they have accumulated much before as part of their long-term purchases. For them, this new move will be beneficial. However, developers choosing to go with the second option of new GST rates, may not be able to hike property prices in the immediate future.

Will it be a boon or a bane, differs from project to project and their ITC that has been accumulated.

Hats off to the smart move played by the Government to control both the buyers and the promoters.

More Articles

- Online Listing Tips for Real Estate Agents

- How to start a Real Estate business in India - a complete guide !

- Renting Vs Buying property - How will you decide?

- What you should do in Property Management services

- Home Loan Insurance

- How to choose your builder?

- How to ensure fire safety in your home!

- Tips To Keep In Mind While Taking A Home On Rent

- Importance of Home Security

- How to plan your property budget?

- Leased vs. Purchased vs. Co-Working Office Spaces

- Easy Tips to Build an Eco Friendly Home

- Sample Flat - A Trick by a Builder?

- How to have a Beautiful Guest Room? Impress your Guests with these Guest Room Ideas..

- Understanding MCLR and its Effects on Home Loans

- 5 simple ways to close a real estate deal

- Is it worth to buy property near an airport ?

- Home loan tax benefit

- How to be successful in business as an introvert

- Cost effective home decor ideas

- What to Be-Paying Guest or a Tenant??

- Complete guide to start your small business

- Sports township- New trend in India

- Online Listing Tips for Real Estate Agents

- Understanding Floor Area Ratio- FAR

- Town and Country Planning | Meaning and Importance

- Checklist of Important Property Documents- All You Need to Know

- Role of CREDAI in real estate

Copyright © 2026 RERA Filing. All rights reserved.

Rera Act

Rera Act

Maharashtra

Maharashtra

Karnataka

Karnataka

Telangana

Telangana

Andhra Pradesh

Andhra Pradesh

Delhi

Delhi

Uttar Pradesh

Uttar Pradesh

Haryana

Haryana

Gujarat

Gujarat

Bihar

Bihar