Benami Transactions

- General

- Author: Shreya Uppal

Highlights

The Benami Transactions (Prohibition) Act, 1988. This Act consisted of only eight sections. The same was later amended by The Benami Transactions (Prohibition) Amendment Act, 2016 which was made up of 72 Sections.

The definition of property under the benami act is very wide and also includes cash. Hence,demonetization transaction would also be termed as a benami transaction.

Real estate is one of the major sectors for the generation and investment of unaccounted money known as ‘black money’ in India. The Prohibition of Benami Property Transactions Act, 1988 was introduced to curb black money transactions to ensure that all the real estate transactions are conducted in the name of the actual owner where the consideration is paid from his known resources.

The original law relating to Benami transactions was laid down in The Benami Transactions (Prohibition) Act, 1988. This Act consisted of only eight sections. The same was later amended by The Benami Transactions (Prohibition) Amendment Act, 2016 which was made up of 72 Sections. Perhaps the most important point is that the new law has retrospective application as it is an amendment to the old Act. Under the old law the rules for acquisition of the property were not notified and therefore if the old Act were to have been repealed and a new Act were to be enacted, an immunity would have been granted to benami transactions undertaken between 1988 and 2016. As a result of making amendments in the old law, a property which could not be acquired before 2016 in the absence of can now be attached.

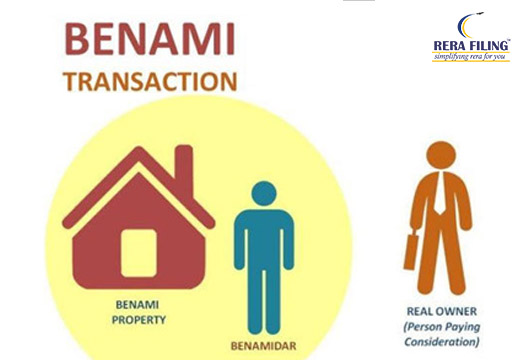

What is a Benami transaction or Benami Property?

Benami Transaction: is a transaction or an arrangement where a property is transferred to, or is held by, a person, and the consideration for such property has been provided, or paid by, another person and the property is held for the immediate or future benefit, direct or indirect, of the person who has provided the consideration.

Benamidar: The other person on whose name the property is shown with or without his/her consent.

Benami Property: Any property which is subject matter of benami transaction. It can be in any form i.e. immoveable, movable. Intangible, tangible, property in converted form and proceeds from the property. This means that not only plots, land and houses are covered but also benami investments in shares, other financial instruments, jewellery etc.

Category of Benami Transactions

1. Where a property related transaction is carried out under a fictitious name – The Benamidar can also be a fictitious person.

2. Where the owner of the property has no knowledge / denies having any knowledge of the ownership of such property.

3. Where the person providing the consideration is untraceable or fictitious – the identity of the beneficial owner may also be unknown.

4. Where payment is provided by person (say A) other than the transferee or person in whose name the property is held (say B) and the property is held for the immediate or future benefit , direct or indirect, of the person who has provided the consideration.

Exceptions to the scope of Benami Transactions:

The following type of transactions will not be treated as Benami transactions:

- Property is held by a member of the HUF for the benefit of the HUF and the consideration is paid from the known sources of income of such HUF

- A person who holds the property in a fiduciary capacity for the other person – for example, a trustee for the trust, a director for his company, a depository/depository participant for a trader (holder of shares in demat form), etc.

- An individual holding property in the name of his spouse or child and where the consideration is paid from the known sources of such individual

- An individual holding property jointly with a brother, sister or lineal ascendant/descendant and where the consideration is paid from the known sources of such individual.

Instances of Benami Transactions:

1. Every state has a certain limit on the amount of agricultural land that an individual or his family can hold. Thus, where such a limit is reached, people try to purchase the property in the name of another person but provide the consideration for the said property.

2. A person who has access to price sensitive information of a company as a result of being in a position of power within the company would not be allowed to trade in the shares of the company since it would amount to insider trading. Therefore, to find a way out of this, they involve a third unrelated party and give him the funds to trade on their behalf.

3. During demonetization, there were many instances of persons depositing old notes into their bank accounts which belonged to another person and then exchanging them for new notes. The definition of property under the benami act is very wide and also includes cash. Hence such a transaction would also be termed as a benami transaction.

Punishment under the Benami Act

1. As per the provisions of the Act, entering into benami transactions is prohibited. A person entering into any benami transaction shall be punishable with the following consequences:

(a) Confiscation of Benami Property without the payment of any compensation.

(b) Imprisonment between 1 to 7 years and

(c) Fine upto 25% of the Fair Market Value of the property.

2. Where a person who is required to provide information under this Act provides false information, he shall be punishable with:

(a) Imprisonment between 6 months to 5 years and

(b) Fine up to 10% of the fair market value of the property.

3. The Act prohibits the resale of the benami property from the benamidar by the real owner and where the benamidar re-transfers the property to the beneficial owner, the transaction for such re-transfer shall be considered ineffective (as if it has never took place).

Latest Blogs

- Rights of buyer under RERA

- Delhi RERA Agent Procedure for Re-validation or Renewal

- MahaRERA guidelines for Real Estate agent training and certification

- Force Majure Clause in RERA

- All you need to know about Relinquishment Deed

- RERA Agent Renewal in Maharashtra

- What is Title Verification and Search Report?

- Revocation under the RERA Act

- RERA Limitations

- Homebuyers right in case of insolvency

Copyright © 2023 RERA Filing. All rights reserved.

Rera

Act

Rera

Act

Maharashtra

Maharashtra Karnataka

Karnataka Andhra Pradesh

Andhra Pradesh Uttar Pradesh

Uttar Pradesh